▪ Throughput increased 11% to 6.99 million TEUs

▪ Revenues grew 14% to US$1.51 billion

▪ EBITDA improved 15% to US$990.54 million

▪ Diluted EPS rose 17% to US$0.235

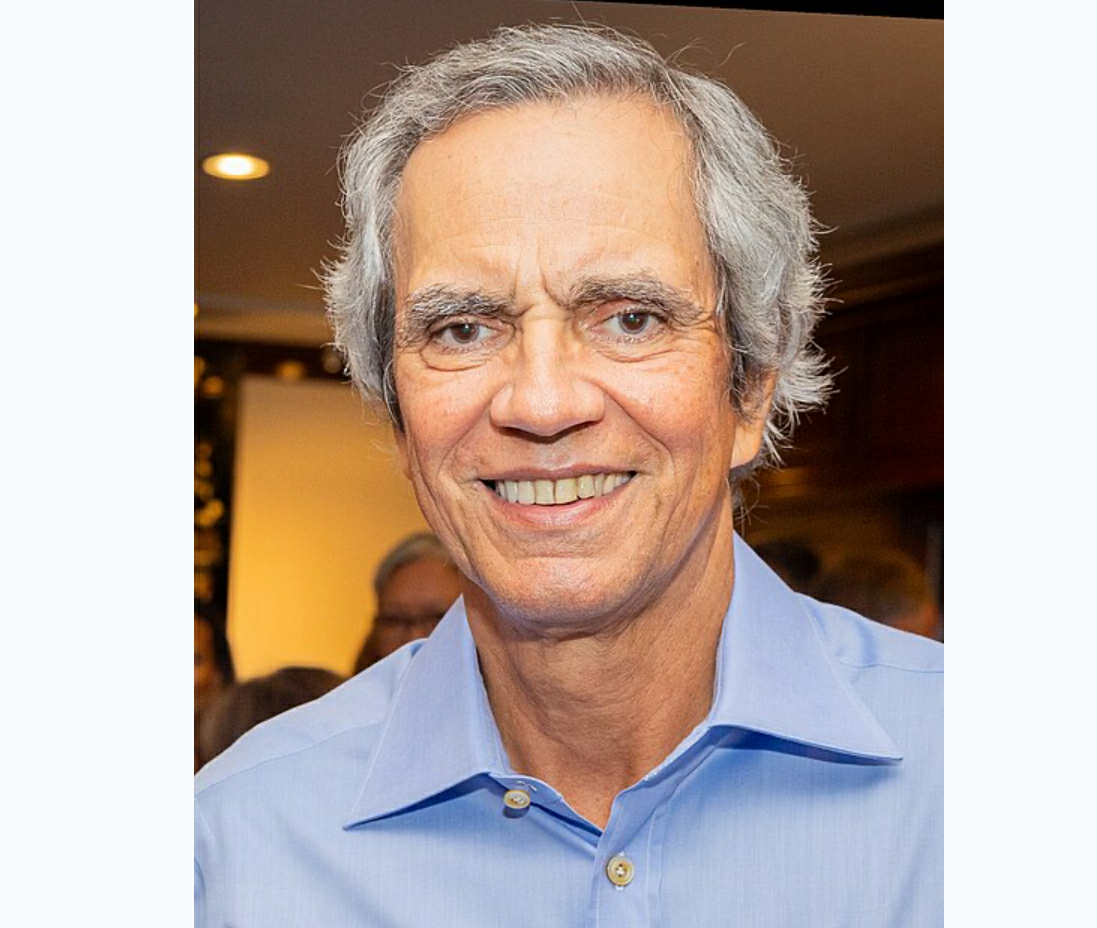

Enrique K. Razon Jr., ICTSI Chairman and President said: “We have continued our strong momentum, with ICTSI’s exceptional performance in the first half of 2025, underscoring the strength and agility of our diversified global operations. With revenue from port operations reaching US$1.51 billion and EBITDA climbing to US$990.54 million, we delivered a record net income of US$483.84 million over the period – up 15 percent year-on-year. This achievement reflects our continued focus on operational excellence, strong balance sheet, strategic expansion, and disciplined cost management.

“We have seen significant growth both operationally, an 11 percent increase in consolidated volume, and in the value we create for our shareholders, with a 17 percent increase in diluted earnings per share, demonstrating the resilience of our business and success of our growth strategy. As we invest in key terminals across the Americas, Asia, and Africa, we remain committed to driving sustainable growth and innovation throughout our global portfolio.”

International Container Terminal Services, Inc. (ICTSI) today reported unaudited consolidated financial results for the first half of 2025 posting revenue from port operations of US$1.51 billion, an increase of 14 percent from the US$1.32 billion reported for the same period in 2024; Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) of US$990.54 million, 15 percent higher than the US$864.99 million generated in the same period last year; and net income attributable to equity holders of US$483.84 million, 15 percent more than the US$420.55 million earned in the same period last year primarily due to higher operating income, partially tapered by higher depreciation and amortization charges. Excluding the income from the settlement of legal claims at ICTSI Oregon and the impact of the deconsolidation of PT PBM Olah Jasa Andal (OJA), Jakarta, Indonesia in 1H 2024, net income attributable to equity holders would have grown 20 percent. Diluted earnings per share increased 17 percent to US$0.235 from US$0.200 in the first half of 2025.

For the quarter ended June 30, 2025, revenue from port operations increased 12 percent from US$684.02 million to US$764.63 million; EBITDA was 11 percent higher at US$500.94 million from US$451.23 million; and net income attributable to equity holders was at US$244.31 million, 16 percent more than the US$210.67 million in the same period in 2024. Diluted earnings per share for the second quarter of 2024 and 2025 was at US$0.101 and US$0.119, respectively.

ICTSI handled consolidated volume of 6,989,075 twenty-foot equivalent units (TEUs) in the first half of 2025, 11 percent higher than the 6,312,163 TEUs handled in the same period in 2024. The volume growth was mainly due to improvement in trade activities across all regions. Excluding the impact of new operations in the Philippines and discontinued operations in Indonesia, the Group’s consolidated volume would still have been up 11 percent. For the quarter ended June 30, 2025, total consolidated throughput was nine percent higher at 3,517,162 TEUs compared to 3,222,044 TEUs in 2024.

Gross revenues from port operations for the first half of 2025 grew 14 percent to US$1.51 billion from US$1.32 billion reported in the same period in 2024 mainly due to the tariff adjustments, volume growth with favorable container mix, and higher revenues from ancillary services at certain terminals, including growth in general cargo activities. This was partially reduced by unfavorable foreign exchange translation impact mainly from the depreciation of Mexican Peso (MXN)-, and Brazilian Real (BRL)- based revenues. Excluding the impact of new operations in the Philippines and discontinued operations in Indonesia, the Group’s consolidated gross revenues would still have increased 14 percent.

Consolidated cash operating expenses in the first six months of 2025 were nine percent higher at US$381.73 million compared to US$349.43 million in the same period in 2024. The increase in cash operating expenses was mainly due to higher volumes, including increases related to the growth in revenue generating ancillary services and general cargo activities at certain terminals, and government-mandated and contracted salary rate adjustments. This was tapered by continuous cost optimization measures and favorable foreign exchange effects mainly of BRL-, MXN- and AUD- based expenses. Excluding the impact of new operations in the Philippines and discontinued operations in Indonesia, consolidated cash operating expenses would still have increased nine percent.

Consolidated EBITDA for the six months of 2025 increased 15 percent to US$990.